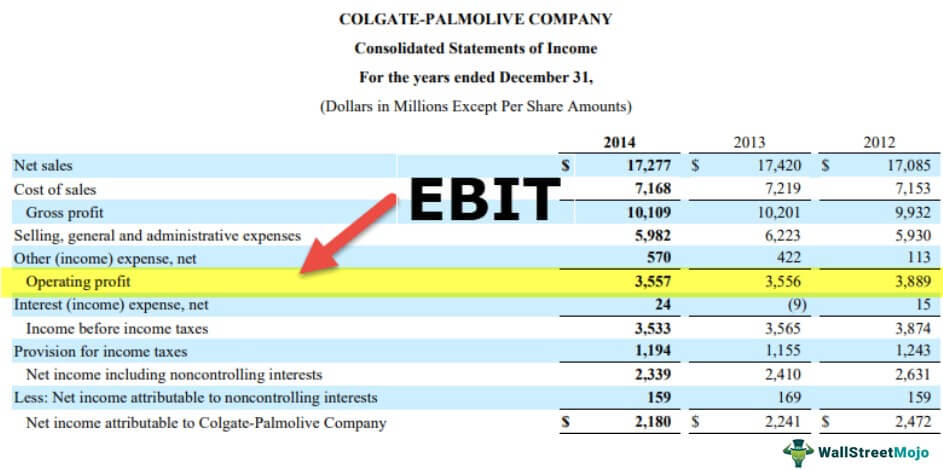

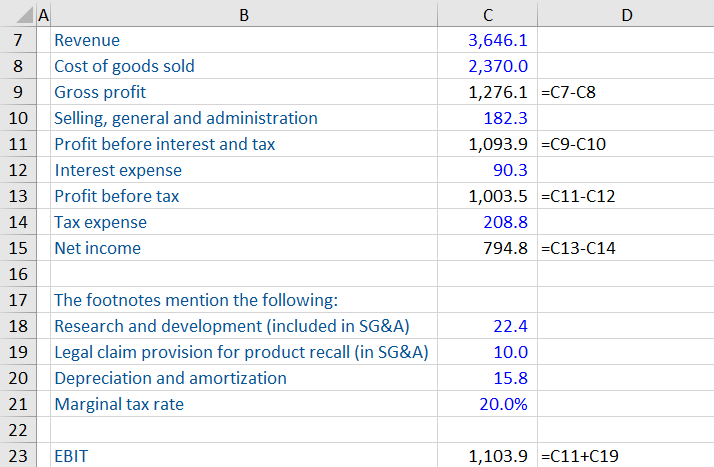

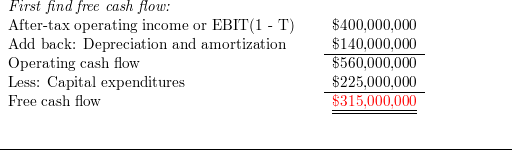

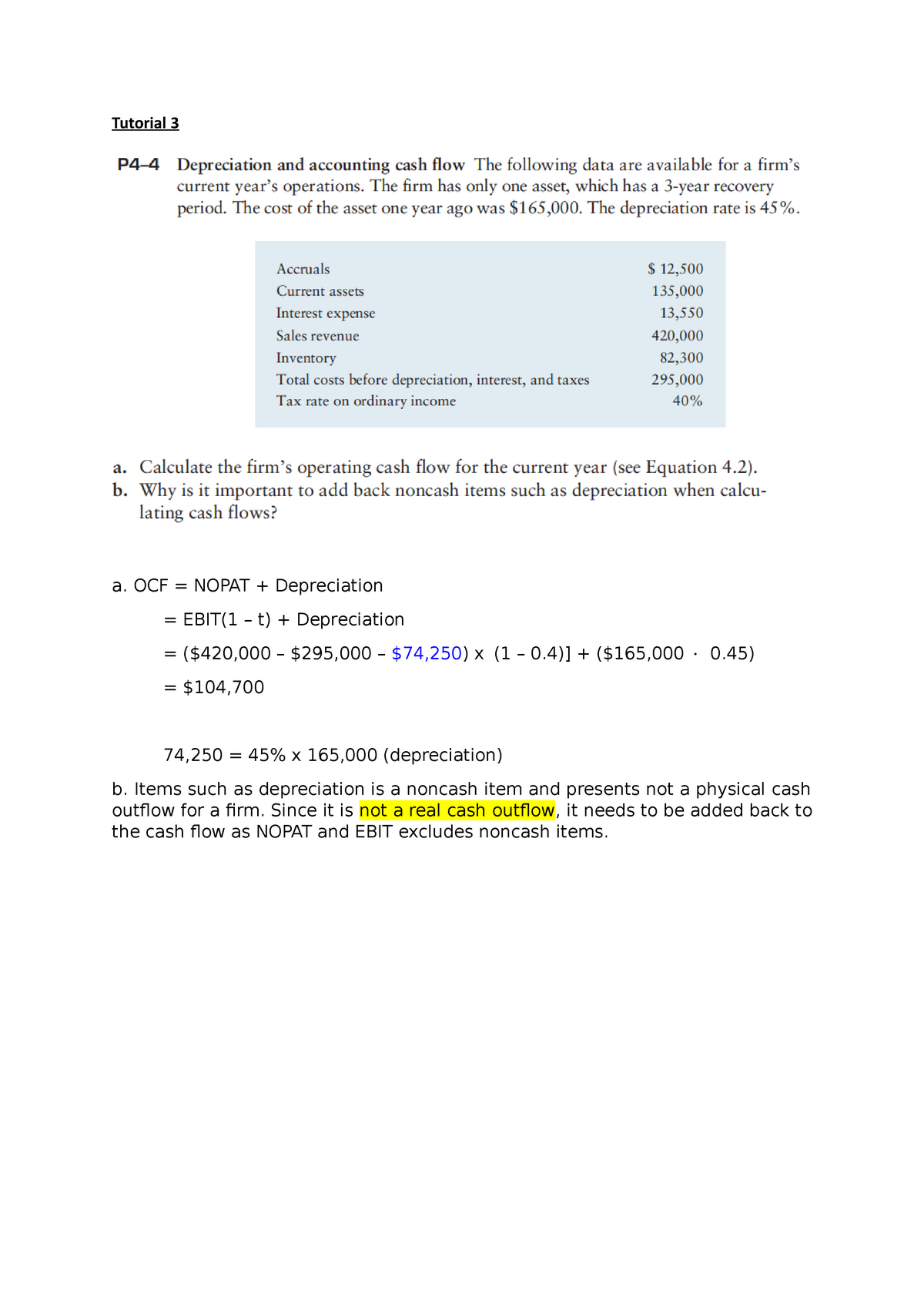

Tutorial 3 FM - Tutorial 3 a. OCF = NOPAT + Depreciation = EBIT(1 – t) + Depreciation = ($420,000 – - Studocu

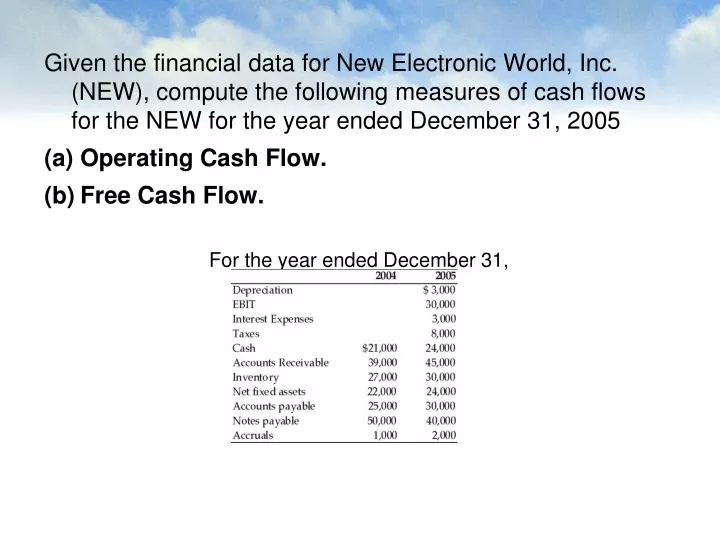

Teton Valley Case Free Cash Flows. Free Cash Flow For each future year you want to calculate: FCF = EBIT(1 – T c ) (no debt tax shields calculated) - ppt download

To calculate Return on Total Assets Ratio, we may either use Net Profits after Tax + Interest or EBIT(1-t) in - Accountancy - Accounting Ratios - 13065121 | Meritnation.com

![EBIT Meaning & How To Calculate It | Rask | [HD] - YouTube EBIT Meaning & How To Calculate It | Rask | [HD] - YouTube](https://i.ytimg.com/vi/Y1gjKWYFm7U/maxresdefault.jpg)