interest rates - SABR Calibration: Normal vs Log-Normal Market Data - Quantitative Finance Stack Exchange

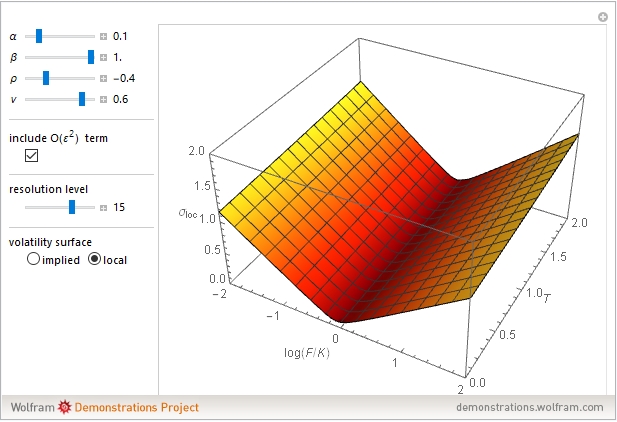

Implied volatility fit (Left) to SABR model using (17), α = 0.7, β =... | Download Scientific Diagram

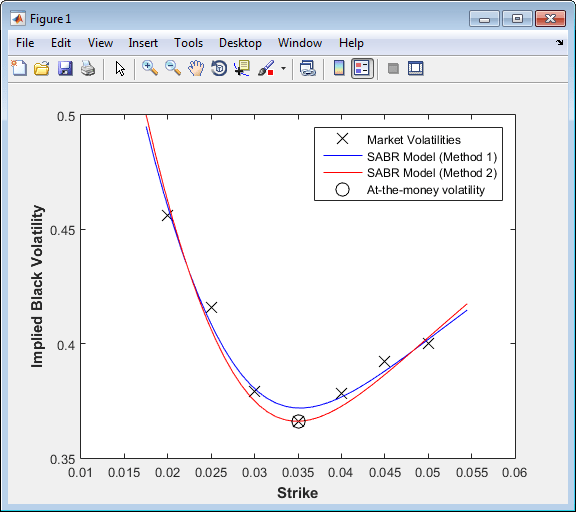

3. The SABR model calibrated to the same market data for = 0 = 1 2... | Download Scientific Diagram

4: SABR correlation (ρ) parameter ρ Correlation. Initially we assign... | Download Scientific Diagram

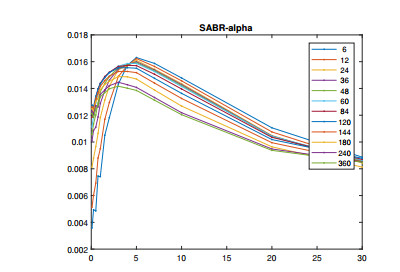

Results of the calibration of the SABR model to swaption volatility... | Download Scientific Diagram

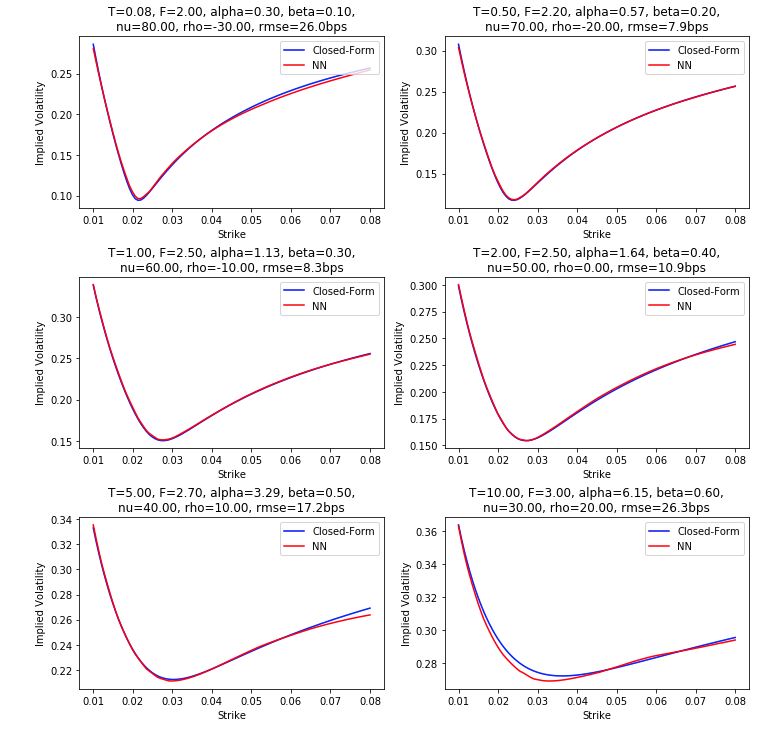

![PDF] Exact Simulation of the SABR Model | Semantic Scholar PDF] Exact Simulation of the SABR Model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/5463942f935282188f78ce1b37befca98eb3afca/12-Figure2-1.png)

![Information In Volatility Structure [1] – Tr8dr – Musings on Algorithms, Models, and the Markets Information In Volatility Structure [1] – Tr8dr – Musings on Algorithms, Models, and the Markets](https://tr8dr.github.io/assets/2017-09-21/SABR-1m-unweighted.png)